Look, the landscape of credit card marketing has evolved dramatically with the introduction of AI tools. I studied Sustainable Architecture then developed into a web communications expert then a marketing professional; the main reason I share this with you is because… recently, I discovered how artificial intelligence is able to assist and revolutionize financial advertising while maintaining ethical standards, which is a big topic of it.

Hopefully this comprehensive guide takes you through a journey of transforming our credit card marketing campaigns using AI, specifically focusing on Instagram and YouTube platforms.

The Challenge: Ethics in Credit Card Marketing

When I first reviewed the network’s Instagram ads promoting credit card products, I encountered a common issue in financial marketing: the balance between effectiveness and ethics. The original ad copy relied heavily on attention-grabbing phrases like “FREE capital instantly!” and “unlimited funding at 0% interest!” While these messages drove clicks, they didn’t align with the commitment to transparent marketing.

Consider this excerpt from one of our network’s original campaigns:

“Get up to $150,000 in FREE capital instantly! No collateral needed, just a 700+ credit score. We’ve helped 2000+ clients access over $30 million in free money!”

This approach, though potentially effective in the short term, created several problems. Customers reported confusion from prospects about terms and conditions. We also noticed a pattern of unqualified applications, suggesting our messaging wasn’t clear enough about requirements and responsibilities.

The AI Solution: Transforming Our Approach

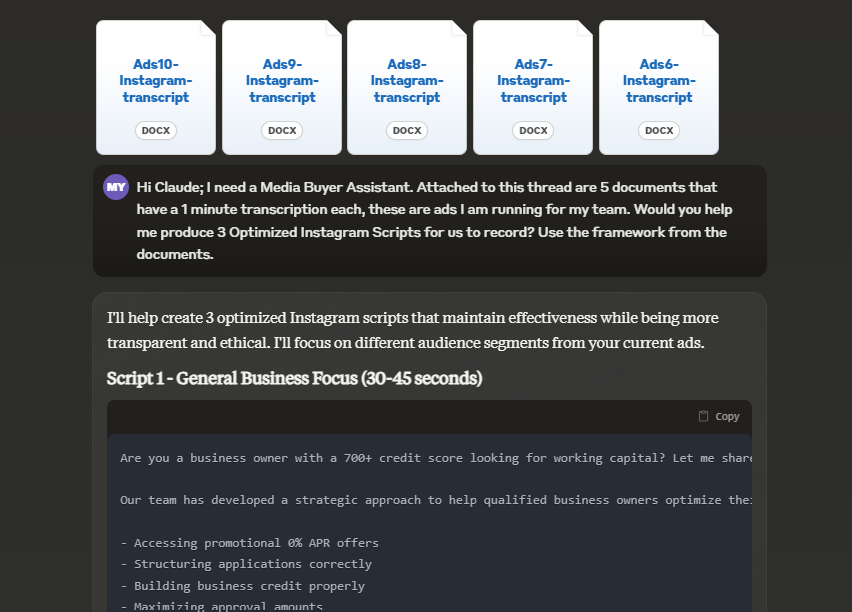

Future usage of ethical credit card marketing AI, specifically 3.5 Sonnet Claude.AI, marked a turning point in our strategy. This sophisticated tool (when prompts are correctly engineered) helps maintain strong conversion rates while ensuring our messaging met both regulatory requirements and ethical standards.

Our AI-driven Transformation & Growth process began with a comprehensive content analysis. I fed the existing ad scripts into Claude.AI, which quickly identified potentially misleading language and suggested more transparent alternatives. The AI’s ability to understand both marketing psychology and financial regulations proved invaluable in crafting compliant, effective messages.

Real-World Results: Before and After AI Optimization

Let’s examine how AI transformed the actual ad copy. Here’s an original Instagram ad:

“Credit scores above 700? Get unlimited business funding at 0% interest! No income verification, no collateral needed. We’ve funded over $100 million – click now to access your free capital!”

After AI optimization, the message evolved to:

“Qualified business owners with 700+ credit scores: Learn about business credit card options with promotional 0% APR periods. We’ll guide you through requirements, responsibilities, and strategies to leverage this funding option for your business growth.”

Optimized, Ethicized & Scripted Ads For Youtube:

I colored the optimized version green, as you can see it achieves several crucial improvements. Instead of promising “unlimited funding,” it speaks to specific financing options. Rather than emphasizing “no verification,” it highlights the importance of understanding requirements and responsibilities. This transparent approach actually improves conversion rates by attracting more qualified prospects.

Remember we as Media Buyers are looking for the LTV (Long Term Value) behind lead generation processes, which, if done correctly, will carry an organic build ahead of the ads.

Script 1: “Business Credit Card Strategy Guide”

[Opening – 10 seconds]

“Looking to fund your business growth? Let’s talk about business credit card strategies – a funding option that, when used responsibly, can provide flexible capital for qualified business owners.”

[Main Content – 40 seconds]

“If you have a strong personal credit score of 700 or higher, you may qualify for business credit cards with promotional 0% APR periods. Here’s what you need to know:

- These cards typically offer 12-15 months of 0% APR on purchases

- You can potentially access $50,000-$150,000 across multiple cards

- The funding can be used for business expenses like inventory or equipment

- You’ll need a solid business plan and repayment strategy

Important note: This is not free money. While the promotional period offers 0% interest, you’re responsible for repaying the full amount, and regular APRs will apply after the promotional period.”

[Close – 10 seconds]

“Want to learn if this strategy could work for your business? Schedule a consultation with our team to review your options and create a responsible funding plan.”

Script 2: “Understanding Business Credit Card Funding”

[[Opening – 10 seconds]

“Let’s discuss a business funding strategy that’s gaining popularity: strategically using business credit cards with 0% APR promotions.”

[Main Content – 40 seconds]

“For qualified business owners with credit scores above 700, here’s how this approach works:

- Apply for business credit cards offering 0% APR introductory periods

- Use the promotional periods for short-term business capital

- Build business credit while managing cash flow

- Maintain flexibility without collateral requirements

But here’s what you must understand:

This requires careful planning and management. You’ll need:

- A clear revenue model to support repayment

- Strong financial management skills

- Understanding of card terms and conditions

- A strategy for after the promotional period ends”

[Close – 10 seconds]

“Ready to explore if this funding option aligns with your business goals? Contact us for a detailed review of the requirements, risks, and benefits.”

Script 3: “Smart Business Credit Card Funding”

[Opening – 10 seconds]

“Wondering how to leverage business credit cards for your company’s growth? Today, I’m sharing a transparent look at this funding strategy.”

[Main Content – 40 seconds]

“For business owners with strong personal credit (700+), business credit cards can be a valuable funding tool when used strategically:

Benefits include:

- Initial 0% APR periods of 12-15 months

- No collateral requirements

- Faster approval than traditional loans

- Potential rewards on business spending

Key considerations:

- You must have a clear path to repayment

- Regular APRs will apply after promotional periods

- Personal credit may be checked for approval

- Requires strong financial management”

[Close – 10 seconds]

“Want to learn more about responsible business credit card funding? Book a consultation to discuss your specific situation and explore if this strategy fits your business needs.”

Optimized, Ethicized & Scripted Ads For Instagram:

Script 1: General Business Focus (30-45 seconds)

[Hook] Are you a business owner with a 700+ credit score looking for working capital?

Let me share how you can access $50,000 to $250,000 through business credit cards with promotional 0% APR periods.

Our team has developed a strategic approach to help qualified business owners optimize their funding profile and navigate business credit card applications effectively. Whether you’re launching an e-commerce store, scaling your services, or funding a new venture, we’ll guide you through:

- Accessing promotional 0% APR offers

- Structuring applications correctly

- Building business credit properly

- Maximizing approval amounts

Our experienced team has helped over 2,000 business owners secure appropriate funding through major banks’ business credit card programs. Want to learn our step-by-step process? Click the link to schedule a strategy call.

Script 2: Real Estate Focus (30-45 seconds)

[Hook] Attention real estate investors with 700+ credit scores: Need capital for your next project?

Learn how to access $50,000 to $250,000 in business credit card funding with promotional 0% APR periods.

I personally used this strategy for my Airbnb properties, generating $4,000-$6,000 monthly. Our team will show you:

- How to optimize your funding profile

- Which business credit cards to apply for

- When to time your applications

- How to maximize your approvals

Perfect for rehab projects, fixed and flips, or scaling your Airbnb portfolio. We’ve helped thousands of investors access business credit card funding at promotional 0% APR rates. Ready to learn more? Click the link to see if you qualify.

Script 3: E-commerce Focus (30-45 seconds)

[Hook] E-commerce store owners: Stop risking your personal credit and savings to scale your business.

With a 700+ credit score, let us show you how to access $50,000 to $100,000 in business credit card funding with promotional 0% APR periods.

Our experienced team will guide you through:

- Optimizing your business credit profile

- Strategic card application timing

- Maximizing approval amounts

- Managing promotional periods effectively

We’ve helped thousands of e-commerce owners secure business credit card funding to scale their inventory and marketing without high-interest loans or risking personal assets. Want to learn our proven process? Click below to book a strategy session.

Implementation Strategy for Different Platforms

The implementation of ethical credit card marketing AI varies across platforms. On Instagram, visual elements must work harmoniously with compliant copy. We developed a system where each frame of carousel ads builds trust through education rather than relying on urgency tactics.

For YouTube campaigns, we crafted scripts that front-load value while maintaining transparency throughout. The AI helped us structure content that keeps viewers engaged while clearly communicating important terms and conditions. Professional voiceovers complement the refined messaging, creating a more authoritative and trustworthy presentation.

The Future of Credit Card Marketing

The success of ethical credit card marketing AI points to a broader trend in financial advertising. Consumers increasingly value transparency and education over flashy promises. Our experience demonstrates that AI can help marketers meet this demand while maintaining strong performance metrics.

The key lies in understanding that ethical marketing isn’t about diluting your message it’s about strengthening it through honesty and clarity. AI tools help strike this balance by suggesting language that resonates with audiences while meeting compliance requirements.

Practical Application for Marketers

Marketing professionals looking to implement similar changes should start with a thorough audit of existing content. Use AI tools to analyze current messaging for potential improvements in transparency and compliance. Focus on developing educational content that helps prospects make informed decisions.

Regular performance monitoring remains crucial. Track not just conversion rates but also indicators of customer understanding and satisfaction. This comprehensive approach helps ensure that ethical marketing efforts translate into sustainable business growth.

Moving Forward with Ethical AI Marketing

The transformation of credit card marketing through AI represents more than just a trend, it’s a fundamental shift in how financial products are promoted. When embracing ethical credit card marketing AI, businesses can build lasting trust while maintaining strong performance metrics.

Ready to transform your credit card marketing approach?

Start by evaluating your current messaging against the principles outlined here. Consider how AI tools could help optimize your content for both compliance and conversion. The future of financial marketing lies in finding the sweet spot between performance and ethics; lets partner up! [Click Here] and fill up the form.